Trust Fund Credifin for Comprehensive Financial Debt Collection Providers

Wiki Article

Proven Techniques for Finance Collection: Depend On the Specialists

In this post, we will certainly direct you via the funding collection process, providing efficient interaction strategies, settlement strategies, and ideas on making use of modern technology. Discover finest methods for legal actions in finance collection.Understanding the Car Loan Collection Refine

To understand the funding collection procedure, you require to trust the experts that are experienced in this field. They have the understanding and also competence to browse the intricate world of debt healing. These experts understand the ins and outs of the lawful structure bordering lending collection as well as can supply beneficial understandings into the most effective techniques for recouping outstanding debts.Car loan collection is not as basic as sending a few pointers or making a few telephone call. It requires a tactical method, tailored to each private consumer's scenarios. The experts have a deep understanding of the different collection techniques available and can determine the most reliable strategy for each and every situation.

By trusting the specialists, you can ensure that the lending collection process is performed skillfully as well as efficiently. They have the essential devices as well as resources to situate and communicate with borrowers, bargain payment terms, and, if essential, initiate lawful procedures. Their experience in handling borrowers from economic circumstances and numerous backgrounds allows them to take care of each instance with level of sensitivity and professionalism.

Reliable Communication Methods With Consumers

Reliable interaction strategies with debtors can significantly boost the success of car loan collection initiatives. By developing clear lines of interaction, you can successfully share crucial information as well as assumptions to consumers, eventually raising the possibility of effective car loan settlement. Overall, efficient interaction is the key to effective finance collection efforts, so make sure to prioritize it in your collection methods.Applying Negotiation Methods for Effective Financial Debt Recovery

When executing arrangement strategies for successful debt healing, you can utilize energetic paying attention abilities to comprehend the borrower's perspective and discover mutually helpful remedies. By proactively paying attention to what the borrower has to claim, you can obtain beneficial understandings into their monetary scenario, factors for skipping, and prospective payment choices. This will allow you to tailor your negotiation method as well as deal suitable remedies that resolve their concerns.Active listening involves giving your full interest to the customer, maintaining good eye contact, and also staying clear of distractions. It additionally suggests asking flexible questions to urge the consumer to share even more info and clarify their needs. By doing so, you can construct depend on as well as connection, which is critical for effective negotiations.

During the arrangement procedure, it is vital to remain tranquil, individual, and empathetic. Recognize that the customer may be experiencing economic problems and might be feeling web bewildered. Be considerate as well as avoid judgmental declarations. Instead, emphasis on discovering commonalities as well as exploring different settlement options that benefit both celebrations.

Utilizing Technology for Reliable Funding Collection

Utilizing innovation can simplify the process of financing collection, making it much more reliable and practical for both lending institutions and debtors. With the arrival of advanced software and online platforms, lenders can currently automate several elements of car loan collection, conserving time and also resources. By applying electronic payment systems, debtors can easily make settlements from the convenience of their very own homes, getting rid of the need for physical sees to the lender's workplace or financial institution. This not only conserves time but likewise decreases the stress and anxiety as well as hassle connected with traditional finance collection approaches.Modern technology permits lenders to check and track financing repayments in real-time. Automated notifications and also reminders can be sent out to customers, guaranteeing that they remain on track with their repayment routines. This aggressive approach helps to minimize the risk of default and also permits lending institutions to take immediate action if any problems arise. Additionally, electronic records and also paperwork make it less complicated to maintain updated and also exact finance this records, minimizing the possibilities of disputes or errors.

On the whole, leveraging modern technology in lending collection boosts performance, minimizes costs, as well as improves the debtor experience. Lenders can concentrate on various other vital tasks, while consumers take pleasure in the comfort of electronic payment alternatives and also streamlined procedures. Accepting technology in financing collection is a win-win for both parties involved.

Best Practices for Legal Actions in Finance Collection

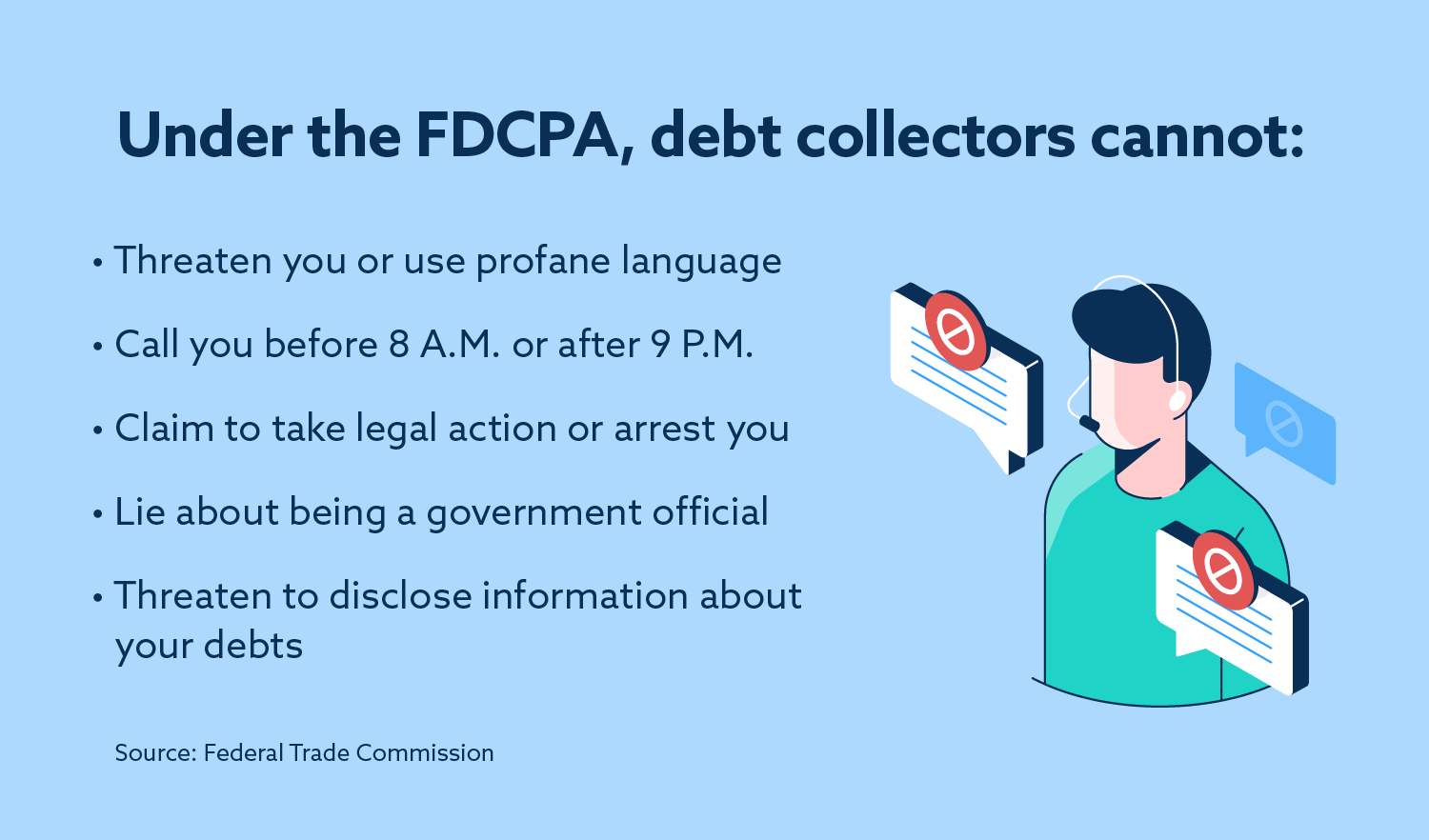

One of the ideal practices for lawsuits in loan collection is to talk to seasoned attorneys that concentrate on financial debt healing. It is critical to have experts on your side who comprehend the ins and outs of financial debt collection legislations as well as laws when it comes to lawful matters. These specialized lawyers can give you with the required guidance as well as experience to browse the complicated lawful landscape and also make sure that your lending collection initiatives are conducted within the limits of the law.

Moreover, these legal representatives can offer useful suggestions on alternative conflict resolution methods, such as arrangement or arbitration, which can aid you prevent expensive and taxing court procedures. They can also guide you in evaluating the dangers as well as prospective outcomes of lawful actions, allowing you to make educated decisions on exactly how to wage your finance collection initiatives.

In general, consulting with knowledgeable attorneys who focus on debt recovery is a necessary finest method when it concerns lawsuits in loan collection. Their knowledge can guarantee that you are following the proper lawful procedures and also maximize your chances of successfully recouping your loans.

Verdict

By recognizing the lending collection procedure, implementing efficient interaction strategies, using arrangement techniques, and leveraging innovation, you can boost your chances of successful financial obligation recuperation. Remember, depending on professionals in loan collection can help you navigate the procedure with self-confidence and also accomplish the wanted end results.Effective communication methods with consumers can greatly improve the success of car loan collection initiatives (credifin). On the whole, reliable interaction is the key to successful financing collection initiatives, so make certain to prioritize it in your collection strategies

Report this wiki page